Top 3 Mistakes on Rental Applications

January 2025

The rental market is ruthless right now. Rents remain outrageously high, with no signs of dropping. Properties disappear instantly or demand credit scores of at least 15,000,000 and incomes 700 times the rent. And when you do find something within your budget, it’s either swarmed by applicants or a dump occupied by a family of raccoons. Then landlords reject applications over a single missed rent payment from three years ago during the Covid layoffs. I am hearing this everywhere.

So, I have put together a list of the top 3 mistakes on rental applications to help tenants strengthen their appearance, increase their chances of acceptance, and overall spend less time looking for a place to rent.

#1 Mistake: Leaving out information or just blatantly lying

This should go without being said but it’s possibly the number 1 reason applications get denied. DON’T LIE. Or omit. Omitting is lying too. Applications will include background checks. Landlords will call past landlords and employers for references.

Credit checks will be pulled. Income will be verified. Anything you lie about will be found and your application is as good as trash. So if you have some issues in your past whether it’s criminal, credit or rental history related, instead of trying to skirt around it do this:

Instead do this:

Write a brief letter of explanation. No more than one page. A couple paragraphs should be enough. Make it professional. Express your side of whatever issues are on your record. Then explain what is different now and why it won’t affect your renting a house in the future.

Yes, it’s possible the landlord may reach out to you and ask you about your history but if you are up against other applications they probably won’t bother. With the letters included in your application they will have the answers to their questions right there and might consider you now.

#2 Mistake: Not Preparing

There’s a lot to do before you’re ready to look at properties available for rent. You need to make sure you have your ducks in a row. If you don’t, when you find a place you like, you won’t be ready to submit a strong application fast. Which is just going to waste your time. Not to mention if you don’t have the cash to pay to apply or first months’ rent and a security deposit it won’t matter even if you’re application does get accepted.

Instead do this:

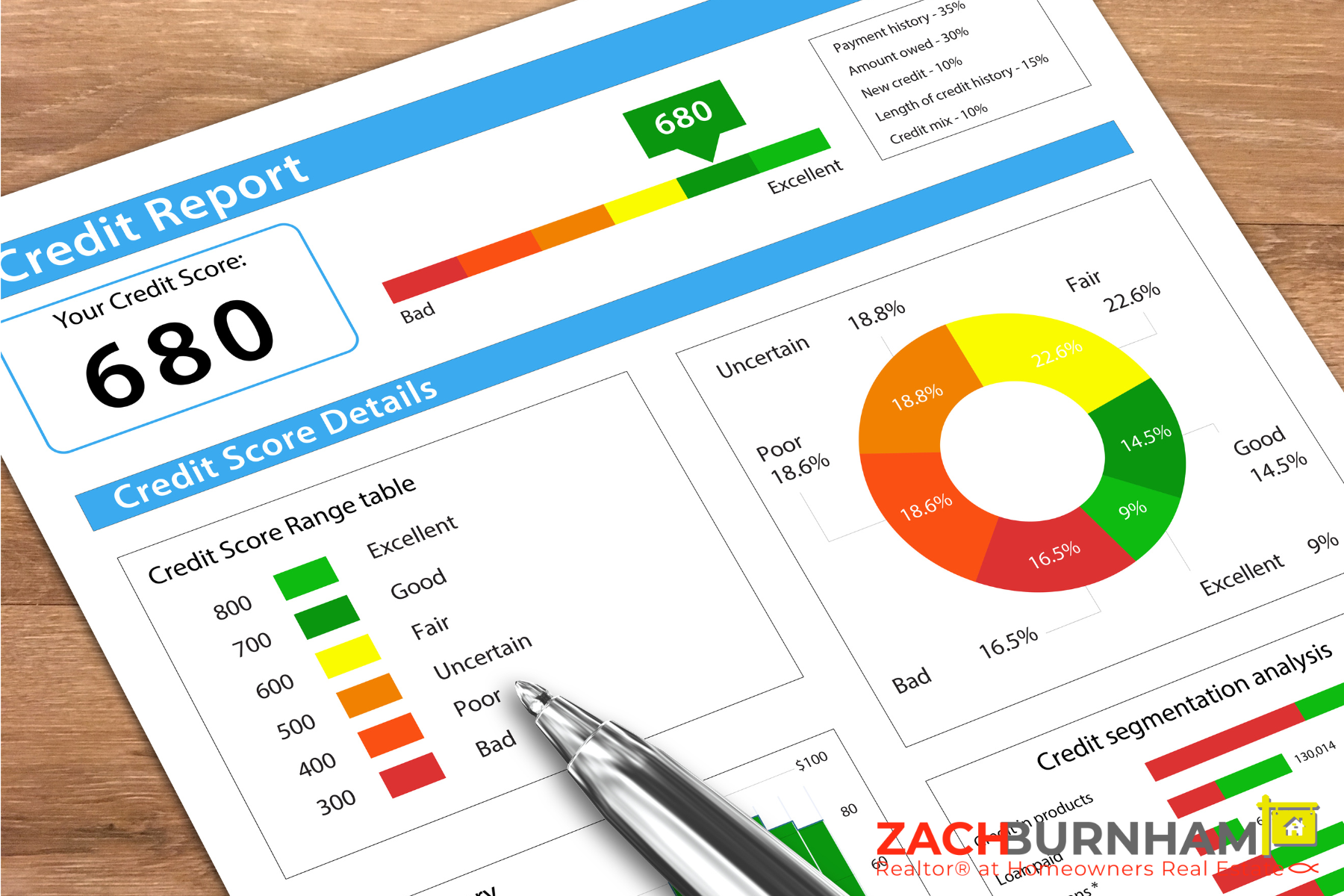

Save money. Look up your credit report. Repair what bad credit you can. You should have a minimum of 2 month’s rent in savings because first month’s rent and a security deposit (can’t be more than one months rent in MD) will be due upon lease signing. A couple hundred dollars more would be ideal because application fees can range from $30-$70 usually.

Pull your credit from any of the 3 free bureaus: Transunion, Equifax or Experian. This will not give you your score but it will show you any negative hits on your record (bills sent to collections, unpaid debts, open and behind credit accounts). If you have a bad enough credit history, check out resources like MyCreditGuy.com or CreditRepair.com. These companies can help you one on one for a fee or they have lot of free tips and tricks out there as well. Check these out and get your credit under control in order to be the strongest applicant possible.

#3 Mistake: Going it alone (without an agent)

A good agent’s assistance cannot be overvalued. This article should be proof of that already. Now not all agents will work with tenants, but a good one will at no cost to you. (Their commission can be negotiated to be paid by the landlord.)

Having an agent on your side means you have someone contractually bound to protect your best interests. If you just use the leasing/landlord’s agent to show you homes, complete your applications, etc., you are unrepresented. They are contractually bound to protect the landlord, not you. Which means they most likely will not be advising you in a way beneficial to anyone but the landlord…

An agent can help you through all of the tips above. Plus assist you with submitting applications, finding available rentals (on or off market), coordinate showings for you, facilitate payments and on and on.

You can even shop agents if you like. Interview a few. You are hiring them, not the other way around. Be open to their advice and guidance but don’t let them dictate your choices. Ask them their background and experience. Discuss what they can do to help you. Only sign a representation agreement with anyone once you choose who you wish to work with full time.

In conclusion

This market is tough on everyone. Avoiding these top 3 mistakes on rental applications will minimize your stress. Do your research, be prepared and honest. Hire a skilled and experienced agent to go to bat for you. All these things will help you be the strongest tenant possible and stand out against other applicants, ultimately saving you time and money.

Check out my full blog page HERE for more real estate advice, tips and tricks!